How does a Tax Depreciation Schedule save you money?

Your property investment (the building) and all associated fixtures and fittings (like curtains, light fittings, etc.), lose value over time due to general wear and tear. The only things that don’t depreciate (lose value) are the land and anything living, like trees and plants!

You can recoup this loss by claiming it as a deduction against your taxable income, including the rental income paid by your tenant.

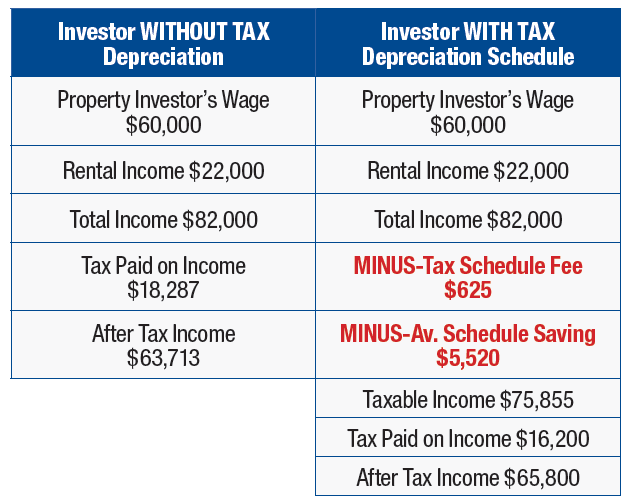

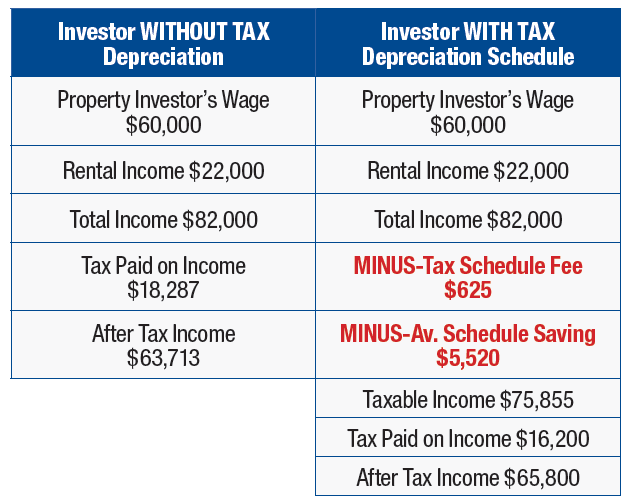

Here’s an example of how depreciation works:

How long does it last?

Typically you can continue to claim depreciation for up to 40 years. The schedule can last a lifetime as it updates when you update your property!

When should you get a Tax Depreciation Schedule done and how often should it be updated?

You should get one completed as soon as you purchase a property for investment purposes. When you spend significant amounts of money on the property, like a renovation for example, you should get your Depreciation Schedule updated. With Real Property Matters, updating a Schedule is fee-free so click here to contact them today!

Can my accountant put a Tax Depreciation Schedule together for me?

No. The Australian Taxation Office do not recognise a Tax Depreciation Schedule completed by an accountant. To establish the construction cost a professional quantity surveyor needs to complete the depreciation schedule.

Final thoughts

It’s important to surround yourself with the information, the education, and the people that are going to help you take positive steps in this process. To learn more about Real Property Matters click here! Learn more about investment property loans or let us help with your property investment journey!